In theory, buying and selling programmatic ad inventory should be a relatively simple transaction. Yet, countless variables can influence an ad’s value — including ad size and position, context, site traffic, geographic location, audience demographics, audience engagement, device type, day and time, market demand, and so much more. Then there’s seasonality; simply put, the same ad on Cyber Monday commands a much higher price because more buyers are bidding during Cyber Five than on January first.

The result? A system that makes it a challenge for buyers and sellers to land on a mutually agreeable price for each ad impression given the myriad of constantly changing variables and inherent complexity.

And, while buy-side technology uses sophisticated algorithms to help advertisers optimize their bids and ultimately save money, most publishers lack the robust data to effectively determine and broadcast to buyers the fair market value of their ad properties. Supply-side technology that leverages data-rich, dynamic pricing can level the playing field and help publishers drive more revenue from their valuable ad inventory.

Price floors 101: static vs dynamic

A price floor is the minimum price that a publisher is willing to accept in exchange for a given ad placement, providing a degree of control over how ad inventory is valued and sold.

Static price floors specify a fixed minimum bid for a given ad placement. Some ad tech platforms allow for tiered price floors based on certain basic variables (such as geographic location or device type) — but even then, the price floor does not change once it’s been set unless it is manually updated.

So finding the optimal static price floor for each ad impression is tricky. Set a floor that’s too high and buyers may not be willing to meet the minimum, leaving unfilled ad space. Set a price that’s too low and risk missing out on valuable ad revenue.

Dynamic floors are different, using advanced technology and data intelligence to estimate the fair market value of an impression at the moment of the auction. Similar to the algorithms used by demand-side platforms (DSP), dynamic pricing tools analyze massive amounts of data in an instant to set the optimal price floor for every impression.

But wait, isn’t price flooring a bad thing?

Recent criticism from The Trade Desk (TTD) regarding price floors and their subsequent decision to essentially ignore price floors established by publishers and supply-side platforms (SSP) has been in the news. While many argue this is a step too far, TTD has raised valid concerns about abusive pricing practices:

- SSPs adding their own commission (or “take rate”) on top of a minimum asking price. For example, a publisher setting a minimum bid of $1.00 might have its inventory sold by an SSP at a rate of $1.20. The publisher receives its minimum asking price ($1.00) and the SSP keeps the additional $0.20. This practice can artificially inflate minimum asking prices set by publishers, so they no longer reflect the actual value of ad impressions.

- Layers of complexity, duplication, and non-transparency. The average publisher works with 20+ different SSPs and exchanges, each of which may apply their own fees and formulas that alter the minimum price presented at auction. As a result, the same buyer may see 20+ different price floors for the identical ad impression. This inconsistency makes it hard to rely on price floors as anything more than an approximation or guideline.

Sovrn Signal is designed to solve both of these problems and provide clear (and fair) price guidance by generating an estimated market rate for an ad impression and then sending it to all demand channels – one price for all.

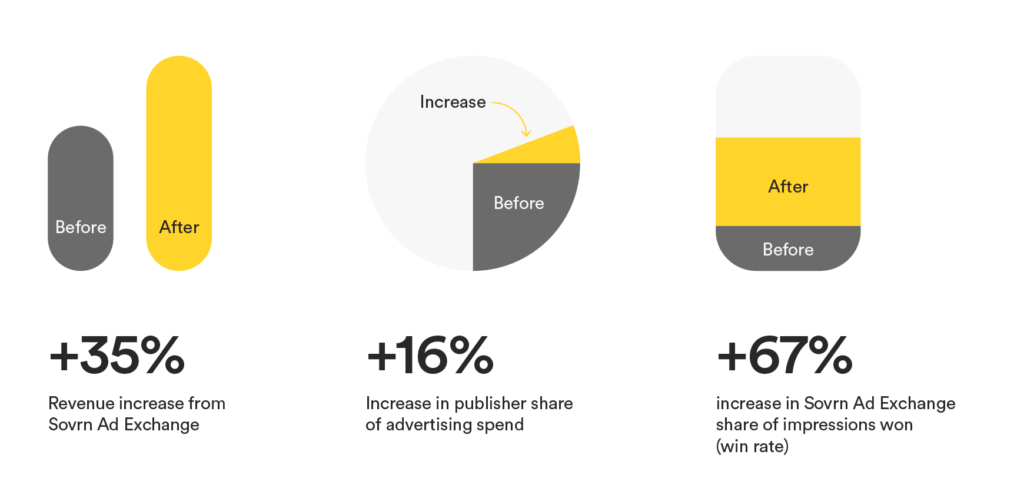

Plus, bundling Signal with Sovrn Ad Exchange eliminates the take rate for impressions sent via the Sovrn SSP, creating a more transparent indicator of fair market value. Not only does this ensure publishers keep 100% of their ad revenue, it offers buyers greater efficiency and ROI, making bids without a take rate more attractive.

Impact of a Zero Take Rate

Dynamic price floors increase ad revenue

It’s easy to see how dynamic price floors could improve programmatic yield in theory. But these two Sovrn customers demonstrate a real-world impact to the bottom line.

- Digital news platform Daily Voice relies on programmatic channels for 90 percent of its ad revenue. They ran static price floors on several SSPs which were updated regularly to capture market movement. However, they needed a better way to maximize programmatic yield. Daily Voice used the data decisioning engine in Sovrn Signal to understand and generate maximum value from every advertising transaction, resulting in a 20% average yield uplift across all ad formats. (Visit the case study for more details.)

- Longtime Sovrn customer Mumsnet was looking to increase both programmatic ad yield and operational efficiency. Despite leveraging static price floors across several SSP partners, they wanted a better way to optimize ad pricing and increase revenue during peak periods. Using the dynamic pricing tool embedded in Sovrn Signal, Mumsnet achieved a 10% overall revenue increase and $0.39 average CPM uplift per ad unit. (Read the case study.)

By adding a single line of JavaScript code to each webpage, both Daily Voice and Mumsnet were able to implement dynamic price floors to:

- Measure the attributes of all impressions including visit details, viewability and attention, audience segments, and addressability.

- Price each ad using those attributes to predict and set the optimal price floor.

- Broadcast the price floor in bid requests to all SSPs.

- Monetize by routing buyers most likely to bid at or above the estimated market price.

Get started today

Ready to start maximizing your ad revenue with Sovrn Signal? Sign up to start your free trial today or reach out to sales@sovrn.com with questions.