(Disclaimer: Sovrn Ad Management is a Jounce Media customer)

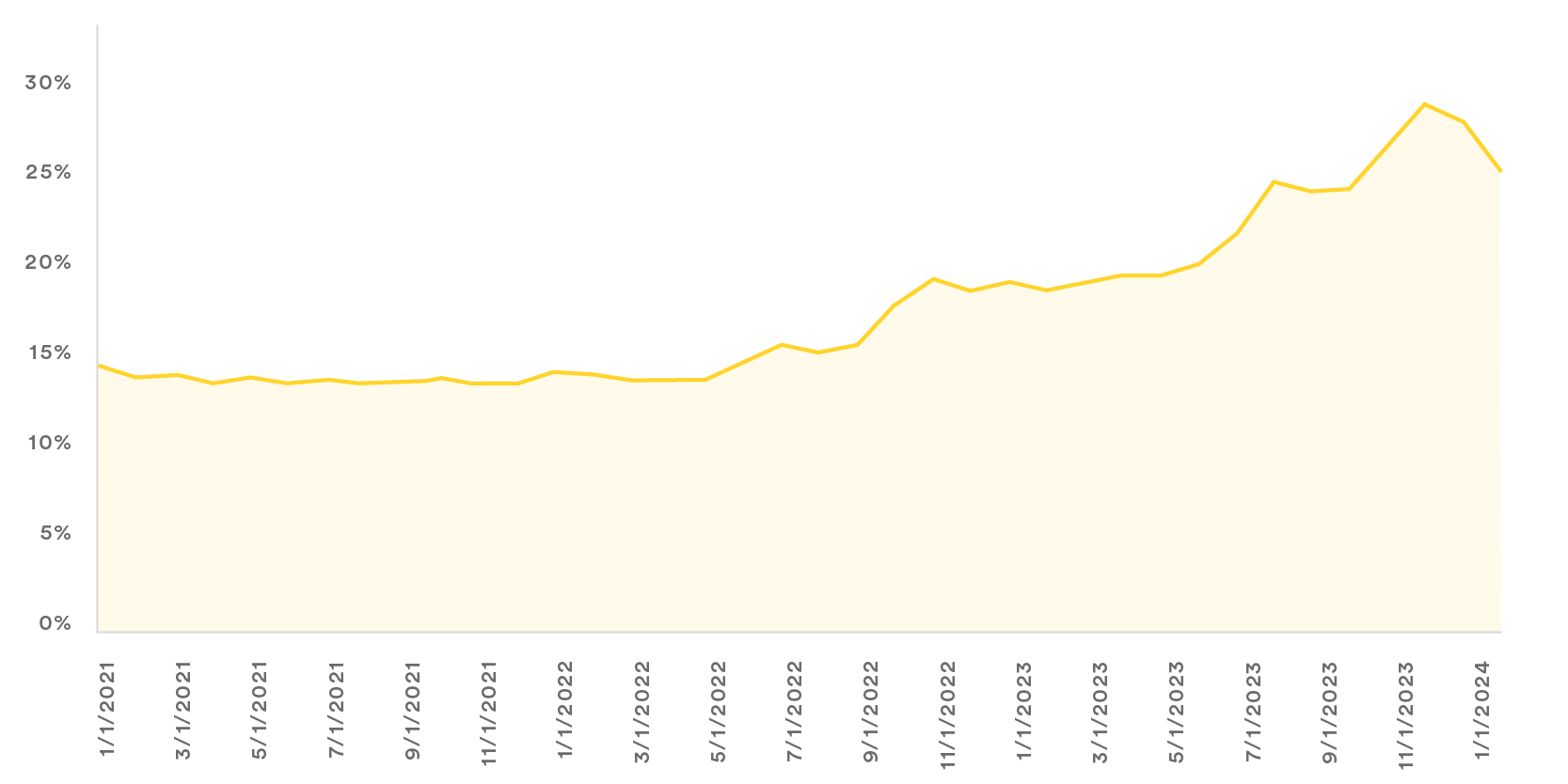

The sales house category has always been associated with the long tail of the internet. So it’s not hyperbole to say that Jounce Media’s March report, which focused on sales houses, made quite a splash. The data showed that the volume represented by the long tail, small-site category using sales houses accounted for more than 25% of bid requests for the entire web.

However, what stands out for me is the incredible growth of the entire category as a percentage of the bidstream, from approximately 12% to 25% in just the last three years, more than doubling.

Sales House as a % of all Web Bid Requests

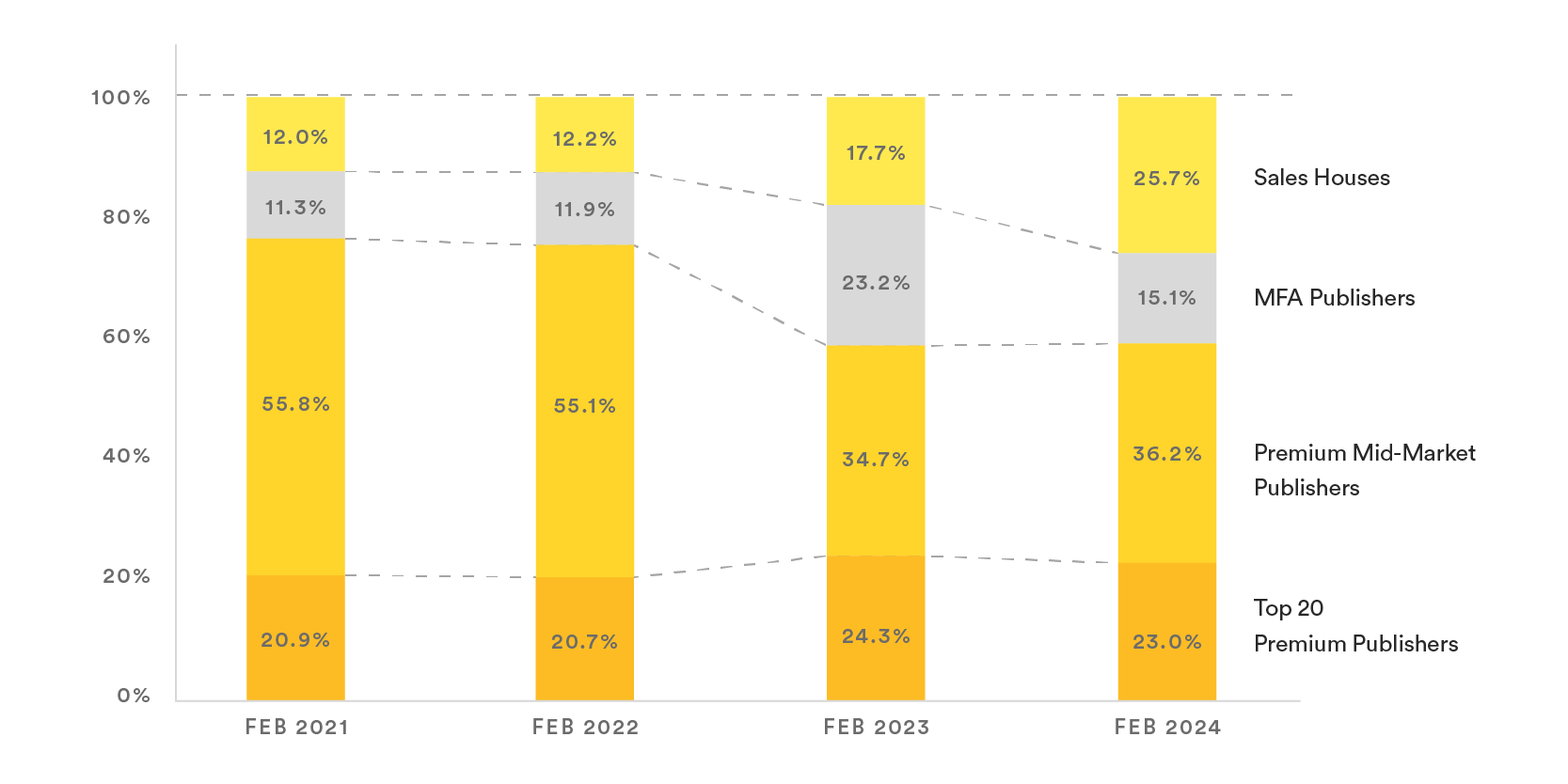

Certain trends in the data show that growth is being powered by an erosion of the mid-market web publisher, with many struggling with the difficulties of running a profitable advertising business in-house and instead turning to sales houses.

Mix of Web Bid Requests

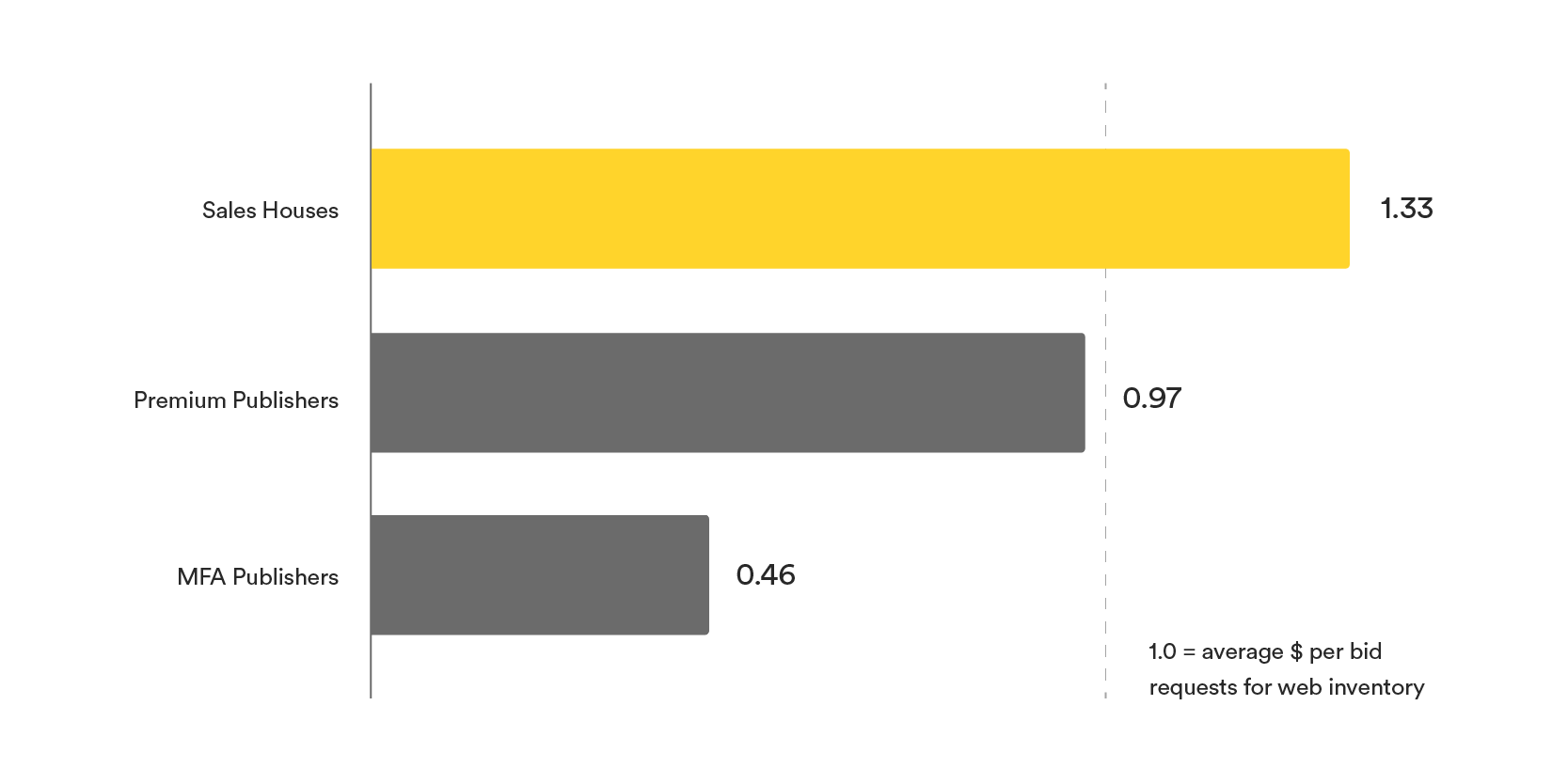

Jounce’s working hypothesis regarding why the category has grown so disproportionately is that sales houses have best-in-class monetization capabilities due to having made investments in yield optimization tech, and that they are the only category with enough scale to warrant those investments. Jounce goes a step further and posits that the entire sales house business model relies on this scale in order to unlock advertising revenue upside across those investments (think dynamic flooring, traffic shaping, and addressability tactics) and that most publishers do not have sufficient funds to justify adding the required large, fixed-cost investments to their in-house capabilities.

With the current economic climate presenting significant challenges for publishers to grow their businesses, many are deciding to pause investments in developing an in-house tech stack. The build vs buy debate is seemingly over, as Neil Vogel, CEO of DotDash Meredith, and Brian Morrissey, founder of The Rebooting, discussed in a recent interview:

“Any publisher that tells you they’re a technology company, run away screaming and sell all your shares. The product expertise, the engineering expertise, it’s just super different. But (as a publisher), understanding and using these technologies is critical.”

More specifically, the March Jounce report posits that sales houses are more effective at monetizing ad inventory than any other cohort. From the report:

“The combined effect of technical mastery and direct sales creates a monetization advantage that most in-house publishers cannot replicate. And this monetization advantage surfaces in our data in the form of high demand scores…… Mid-market publishers appear to be reluctant to hand over the keys to a sales house, but mid-market publishers are also unable to make the necessary investments to achieve in-house monetization excellence. The outcome is a squeeze of the middle. Sales houses are bringing technical mastery to the smallest sites, enabling those companies to occupy a growing share of the bidstream. The largest premium publishers similarly can invest in monetization excellence that has enabled them to occupy a growing share of the bidstream.”

Jounce Demand Score for Web Inventory

But why doesn’t everyone jump to the sales house category?

The caveat here is, through the lens of a mid-market publisher, sales house solutions typically come with a compromise in control. More specifically, working with a sales house and leveraging their monetization capabilities requires handing over complete control over how programmatic inventory is managed — and which partners you work with. This can lead to a lack of transparency in performance, along with data leakage risks and potential channel conflicts of managing access to inventory/audiences across sales teams. For publishers with direct sales efforts, this lack of control can make the decision to transition the management of their programmatic inventory untenable — or one filled with unacceptable compromise.

Equally as important are concerns of adding yet another revenue share. With some sales house revenue shares taking 20 or sometimes 30% of the bid price, it’s no wonder mid-market publishers might prioritize improving their own in-house capabilities as a better bet on ROI.

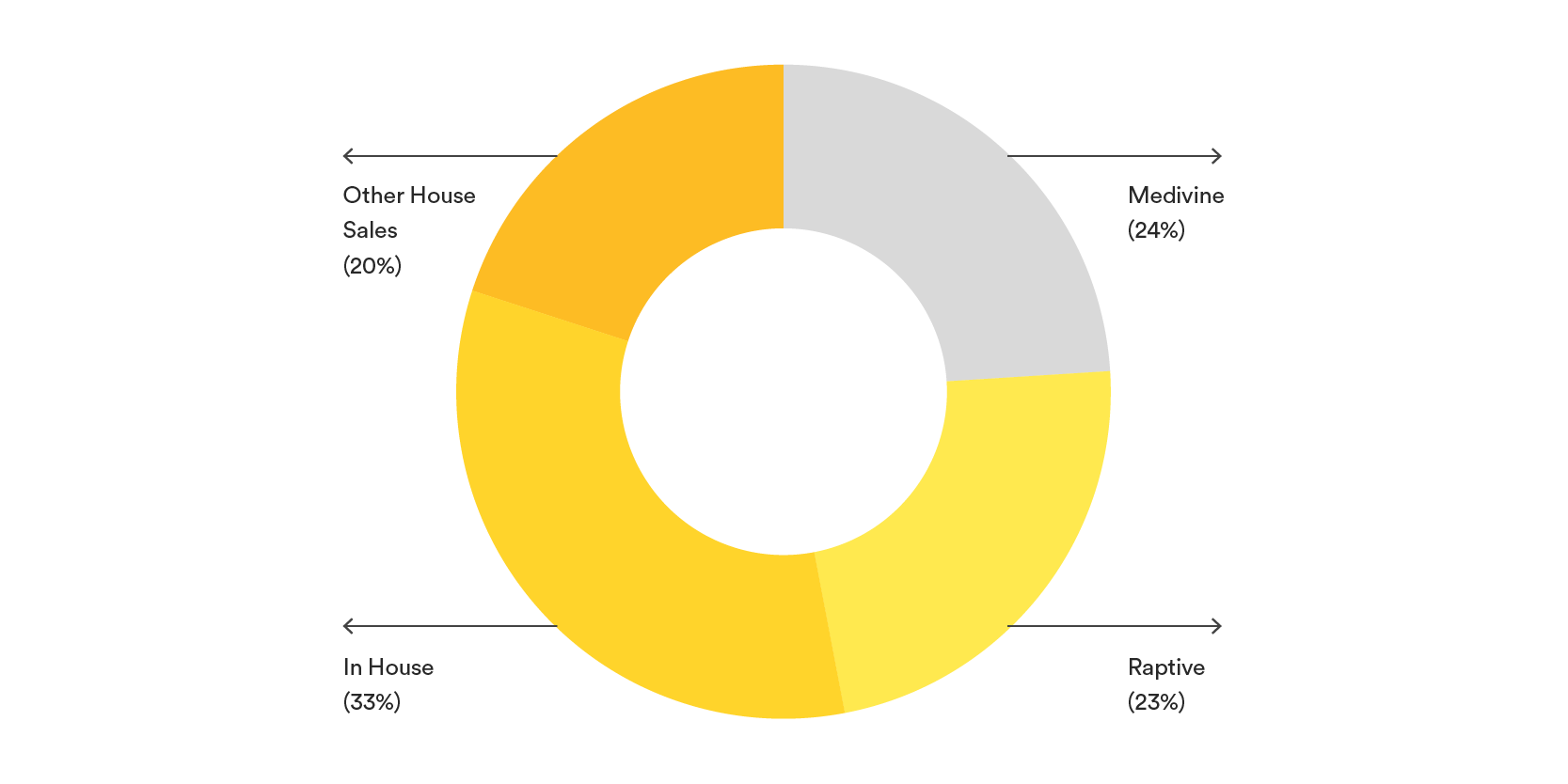

We see this in many of our conversations with publishers that currently work with other sales houses, as well as in Jounce’s sales house churn data. With many publishers not convinced of the margin returns of adding yet another rev share into the mix (after all just 36% of marketer budgets end up as working media and make it through to the publisher) while a little under half of the publishers end up as customers of the top 2 market leader sales houses, a whopping 33% of publishers who churn from the category go back to in-housing. It’s this category of publisher that we believe is underserved. What if a sales house could solve for these compromises?

Current Monetization of Sites that have left a Top-10 Sales House

But it’s not just the sales house tax that needs fixing

At Sovrn, we believe the hidden costs represented by SSPs — and indeed, sales house rev shares — are unaccounted for by many publishers when managing their businesses and P&Ls. This hidden “ad tech tax” makes it that much harder to compete and is something that doesn’t find its way onto earnings reports. The ad tech industry’s revenue-sharing model, initially streamlined business but now burdens publishers financially. With fees deducted from earnings, many publishers remain unaware of the significant revenue leakage.

Having been on the vendor side of the supply-side for the past decade, I’ve often been asked by publishers why and how SSPs can justify charging differently on an impression transacting at a $5 CPM vs one transacting at $0.50 CPM. The answer to this question is, of course, “In an era of volume-based discounts, post auction discounts and rebates, there is no delta in operational costs for serving a less valuable impression, so why do we insist on this model?”

The ad tech industry was built on revenue shares. The pricing model was favored by the industry because it made it easy to do business. Publishers could get started with a new partner because (perceived) risk was mitigated.

As one of our steering committee members, Samuel Youn, VP Programmatic at Chegg, said in a recent op-ed, “Rev shares create a dependency on short-term thinking and don’t encourage meaningful partnerships…revenue share fees should in theory align performance incentives between SSPs and publishers, however (due to rebates and post auction discounts) … revenue shares are no longer straightforward.”

This leads to premium publishers, who invest in quality content and attract valuable audiences, subsidizing less desirable inventory saturating the internet. The SSP category benefits tremendously from this model by earning variable rev shares, while their unit costs remain consistent. Premium publishers, however, pay out significant non-visible sums, typically $1.5M to $2M for every $10M generated in programmatic revenue.

A New Model

What would happen to the financial outlook and viability of the open web if we could change the model into something that is more transparent and sustainable? At Sovrn, we’re taking a different and more intentional approach to tackle the opportunity of the under-served mid-market publisher. The data presented in Jounce’s March report points to an opportunity for both the SSP and the sales house to evolve.

And, what if a sales house could eliminate some of the trade offs referenced above by moving toward a more software based model? Through leveraging a modular ad management platform that offers increased control and flexibility, publishers can finally leverage best-in-class yield optimization tools in a self-serve capacity. Publishers could maintain control over their sales channels and buyer relationships, while foregoing the overhead costs of developing their own proprietary yield optimization tools in order to compete. They would have access to all of the different components of the monetization stack of a best-in-class, sales house monetization engine without having to build it themselves.

In addition, Sovrn has intentionally eliminated the SSP rev share for customers across our Ad Management and Signal product lines. In lieu of a rev share, the publisher can bundle those products and pay a monthly SaaS fee that’s volume based and predictable. The data supports the argument that this is a win for all parties involved. A win for the publisher in a number of ways (a reduced net effective take-rate with SSPs, a larger share of the working media dollar, a more competitive auction and therefore more revenue); a win for advertisers (more transparency, increased reach and efficiency); and a win for Sovrn (in having a more predictable SaaS revenue stream). Here’s a case study with more details.

The Software Opportunity

Getting rid of rev shares isn’t the only opportunity here. As the ad tech ecosystem has flourished, so too has the number of “toll booths” that require publishers to pay some kind of price in order to operate, including ad verification, ad quality and cybersecurity costs, CMPs, adblock recovery, unified reporting solutions, and more. These are all costs the publisher is saddled with, hindering margins and reducing economies of scale. So this year, at the behest of our Ad Management steering committee, we’ve begun bundling-in and assuming many of these “toll booth costs” into our SaaS fees.

On a personal level, I’ve been obsessed with building tools for publishers since I left the publisher side almost a decade ago. At Sovrn, I firmly believe we are providing an operating system for publishers across advertising and commerce products that delivers on the full promise of the SSP when the category emerged 15+ years ago: Ensuring publishers avoid disintermediation and can compete and thrive at scale.

What are your thoughts? (click here for the original Linkedin post)